Schister systems uses the following data in its cost-volume-profit analysis – Schister Systems’ data-driven approach to cost-volume-profit (CVP) analysis empowers the company to make informed decisions, optimize profitability, and navigate market dynamics effectively. This analysis involves utilizing specific data points to understand the relationship between costs, sales volume, and profit, providing valuable insights for strategic planning.

By leveraging CVP analysis, Schister Systems gains a comprehensive understanding of its cost structure, variable and fixed costs, break-even point, and margin of safety. This knowledge enables the company to identify areas for cost optimization, set realistic sales targets, and respond proactively to changes in the business environment.

1. Overview of Cost-Volume-Profit (CVP) Analysis

CVP analysis is a financial tool used to assess the relationship between costs, volume, and profit. It helps businesses understand how changes in sales volume and costs affect their profitability.

The key components of CVP analysis are:

- Cost:The total expenses incurred by the business, including both variable and fixed costs.

- Volume:The number of units sold or produced by the business.

- Profit:The difference between revenue and total costs.

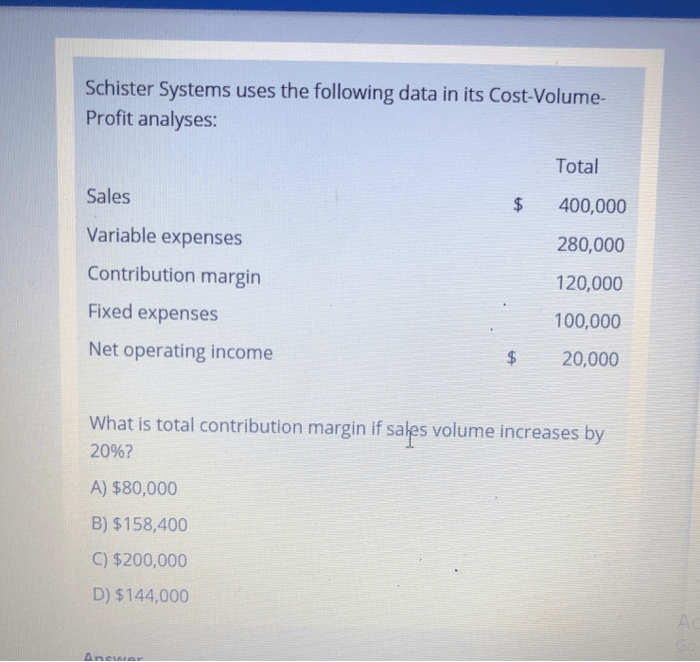

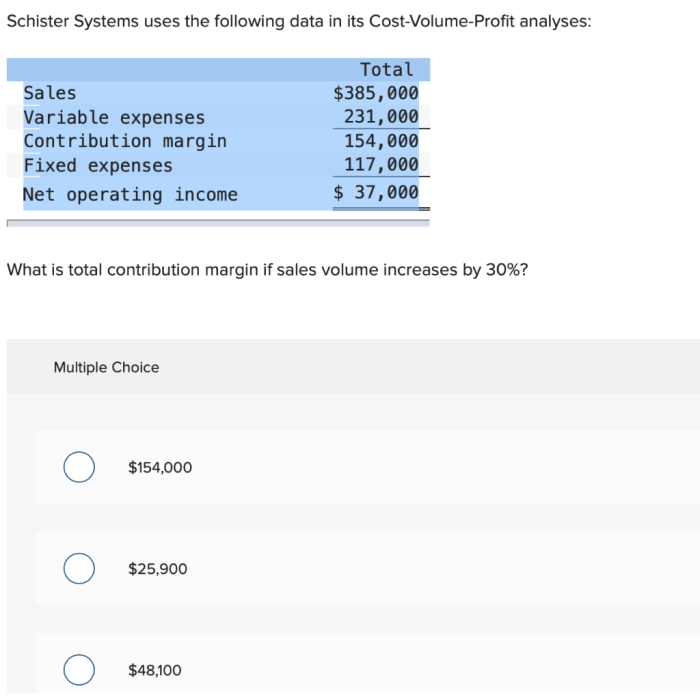

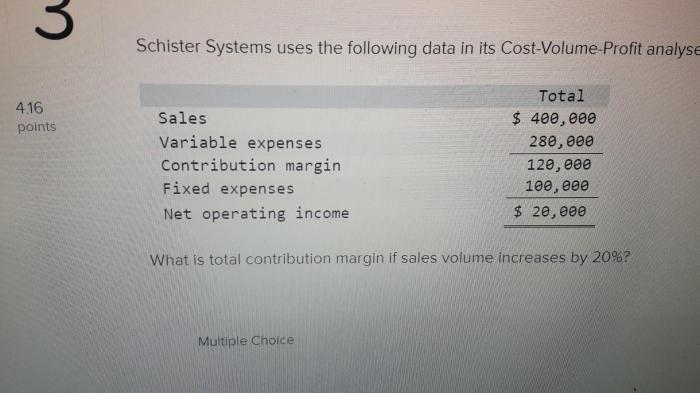

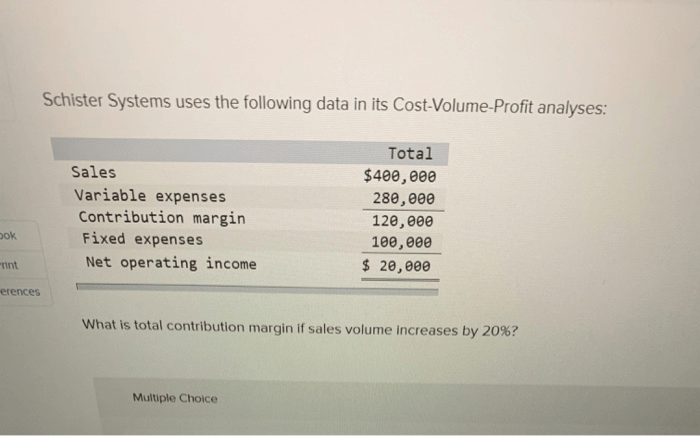

2. Data Used in Schister Systems’ CVP Analysis

Schister Systems has provided the following data for its CVP analysis:

- Selling price per unit: $10

- Variable cost per unit: $5

- Fixed costs: $20,000

These data points are relevant and necessary for CVP analysis because they allow Schister Systems to determine the following:

- The break-even point, which is the sales volume at which the company will neither make a profit nor a loss.

- The margin of safety, which is the difference between the actual sales volume and the break-even point.

- The impact of changes in sales volume, variable costs, and fixed costs on profitability.

3. Variable Costs and Fixed Costs

Variable costs are costs that change with the level of production or sales. Examples of variable costs include raw materials, direct labor, and commissions.

Fixed costs are costs that remain constant regardless of the level of production or sales. Examples of fixed costs include rent, salaries, and insurance.

Schister Systems incurs both variable and fixed costs. Its variable costs include the cost of raw materials and direct labor, while its fixed costs include rent and salaries.

4. Break-Even Point: Schister Systems Uses The Following Data In Its Cost-volume-profit Analysis

The break-even point is the sales volume at which the company’s total revenue equals its total costs. At the break-even point, the company neither makes a profit nor a loss.

To calculate the break-even point, we use the following formula:

“`Break-even point = Fixed costs / (Selling price per unit

Variable cost per unit)

“`

Using Schister Systems’ data, we can calculate the break-even point as follows:

“`Break-even point = $20,000 / ($10

$5) = 4,000 units

“`

This means that Schister Systems must sell 4,000 units to break even.

5. Margin of Safety

The margin of safety is the difference between the actual sales volume and the break-even point. It measures the company’s ability to withstand a decline in sales volume without incurring a loss.

To calculate the margin of safety, we use the following formula:

“`Margin of safety = (Actual sales volume

Break-even point) / Actual sales volume

“`

Let’s assume that Schister Systems sells 5,000 units. Its margin of safety would be calculated as follows:

“`Margin of safety = (5,000 units

4,000 units) / 5,000 units = 20%

“`

This means that Schister Systems has a 20% margin of safety. This indicates that the company can withstand a 20% decline in sales volume without incurring a loss.

FAQ Explained

What is the significance of the break-even point in CVP analysis?

The break-even point represents the sales volume at which a company neither makes a profit nor incurs a loss. It is a critical metric for understanding the minimum sales required to cover all costs.

How does Schister Systems use CVP analysis to optimize profitability?

Schister Systems utilizes CVP analysis to identify areas where cost reductions can be implemented without compromising product quality or customer satisfaction. By optimizing its cost structure, the company enhances its profit margins and overall financial performance.

What are the limitations of CVP analysis?

CVP analysis assumes that variable costs and fixed costs remain constant, which may not always be the case in real-world scenarios. Additionally, it does not consider the impact of non-linear relationships between costs and volume, or the influence of qualitative factors on profitability.